He has labored as an accountant and consultant for more than 25 years and has constructed monetary fashions for all sorts of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a supervisor and an auditor with Deloitte, an enormous four accountancy agency, and holds a degree from Loughborough University. Used when items or services are provided to a buyer in the present fiscal 12 months but are not billed for until the following fiscal yr.

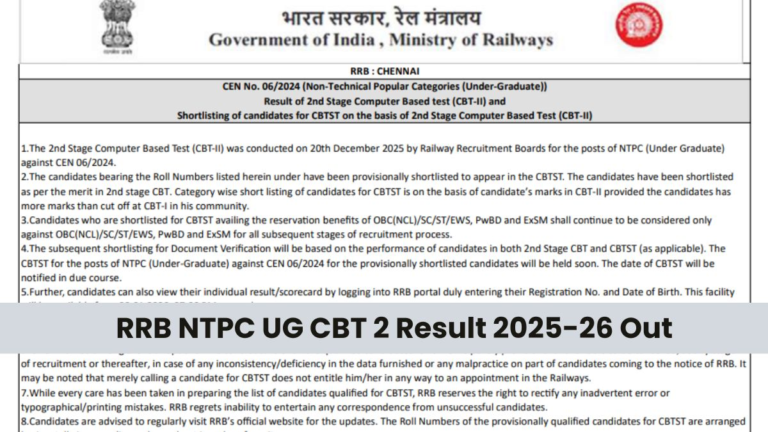

What’s The Basic Difference In Accrued And Deferral Foundation Of Accounting?

Equally, accruals and deferrals are additionally recorded because the compensation for them has already been acquired or paid for. Therefore, one side of the double entry of the transaction is already acknowledged. Nevertheless, for the explanation that matching concept will not allow them to be recognized as incomes or bills, they must be recorded in the books of the enterprise to complete the double entry. Subsequently, these are recognized as belongings and liabilities as a substitute of incomes or expenses. Common reconciliations between accounts payable and receivable may help catch any discrepancies.

Accrued and deferrals have an result on the revenue statement by rising or decreasing specific revenues and bills. Moreover, sure deferrals similar to depreciation or amortization charges can have an effect on a company’s financial performance for a given accounting cycle. Deferred expenses are payments to a 3rd celebration for services or products recorded upon delivery. If you prepay $1,200 for a 12-month coverage at $100 monthly, you only acknowledge $100 as an expense for the current accounting interval and defer the remaining $1,100.

It may also lead to inaccurate tax filings or breach contractual obligations. On the other hand, deferring bills entails delaying their recognition till a later period. For instance, if you buy a year-long insurance policy upfront, you probably can acknowledge the expense evenly over the period of coverage quite than all at once. In this discussion, you’ll learn about the important thing points concerning accruals for revenue and expenses. Seasoned accountants must estimate bills which have been incurred however not yet paid, such as utilities, taxes, or interest.

Earnings Statement

• Accrued revenues are reported in the meanwhile of sale, but funds are still being processed. For occasion, a company uses electrical energy to energy its operations and pays for this consumption later when the meters have been read and the bill arrives. It’s widespread for corporations and customers to prepay or pay later for goods https://www.simple-accounting.org/ and services. Barbara is a monetary author for Tipalti and different successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech firms with Deloitte audit expertise. When she’s not writing, Barbara likes to research public corporations and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg.

By using accrual accounting, businesses can present a extra correct illustration of their monetary efficiency and position. Accrual accounting stands as a cornerstone of contemporary accounting practices, a technique that provides a more complicated but correct image of a company’s financial well being than the simpler money accounting. Unlike money accounting, which records transactions solely when cash modifications arms, accrual accounting recognizes financial occasions in real-time, no matter when actual money transactions occur. This strategy aligns income and expenses to the period they relate to, making financial statements more reflective of a company’s operations and financial place. Accurate timing through accruals and deferrals is crucial for ensuring that financial statements mirror the true financial place of a company. By correctly recognizing income and bills based on when they’re earned or incurred somewhat than when cash exchanges arms, businesses can provide stakeholders with dependable info for decision-making functions.

- Deferred expenses may also apply to deferred intangible belongings owing to amortization or tangible asset depreciation expenses.

- From the attitude of a small business proprietor, accrual accounting offers insights into future cash flows and obligations, enabling higher planning and budgeting.

- In the fiscal shut certification letter, Deans, Chairs and Enterprise Officers certify that there are not any materials unrecorded liabilities.

- Via these factors, it’s clear that accruals aren’t only a technical side of accounting; they are integral to the transparency and reliability of economic reporting.

From the angle of a enterprise proprietor, adjusting entries for deferrals are essential for presenting a true and truthful view of the financial health of the business. They ensure that earnings statements replicate the precise earnings and expenditures associated to the present interval, which is crucial for making knowledgeable enterprise selections. Accounts payable might enhance with accrual accounting as payments are recognized even earlier than payment is made.

But as an alternative of itemizing incomplete transactions as bills, deferrals treat accomplished transactions as belongings. It converts them to expenses later within the fiscal year, usually after the delivery of all products and services. For example, when you present a service in December but aren’t paid until January, you’d nonetheless record it in December as accrued income. On the other hand, should you receive payment in advance for a service you’ll ship later, you’d report that payment as deferred income until the service is full. For bills incurred however not yet paid, the accountant would debit the “expenses” account on the revenue statement and credit the “accounts payable” account on the balance sheet. This increases a company’s expenses and accounts payable, the place a firm’s short-term obligations are logged.

Accrual and deferral are two basic accounting ideas that play an important function in recognizing revenue and expenses in financial statements. Whereas both methods aim to match earnings and bills with the period in which they are incurred, they differ in phrases of timing and recognition. In this text, we are going to explore the attributes of accrual and deferral, highlighting their key variations and functions. In abstract, the impression of accruals and deferrals on financial statements is profound, as they make certain that these documents replicate the true financial actions of a business, beyond mere money transactions.

External stakeholders such as buyers, collectors, and regulators depend on correct monetary reporting to assess the company’s profitability, liquidity, solvency, and general financial stability. Accurate financial statements enhance transparency and trust among these stakeholders, which might result in elevated investor confidence and improved entry to capital. Since deferred income just isn’t recognized as income immediately, it can result in decrease profit margins and return on property.

Usually accepted accounting rules (GAAP) require businesses to acknowledge income when it’s earned and expenses as they’re incurred. Typically, however, the timing of a payment might differ from when it’s obtained or an expense is made, so accrual and deferral methods are used to adhere to accounting rules. Accruals for expenses contain recognizing and recording bills within the accounting period that they relate to, even if the payment is not yet made.